This Winter is Cold, Germany’s Economy is Colder

As winter grips Germany, the chill in the economy feels even harsher. Once the engine of Europe, Germany now faces a deep economic freeze marked by stagnation, structural weaknesses, and a wave of industrial decline. Factories are relocating abroad, businesses are shuttering, and job cuts are sweeping across multiple sectors. The question is no longer whether Germany is slowing down—it’s how long this economic winter will last.

The Economic Frost: A Snapshot

Germany’s GDP growth has hovered near zero for three consecutive years, with 2025 projections signaling continued stagnation. High energy costs, rigid regulations, and geopolitical uncertainties have eroded the foundations of the German model. The loss of cheap Russian gas and rising global competition have compounded the crisis, leaving companies cautious and consumers hesitant.

Industries in Decline

The downturn spans across Germany’s industrial backbone:

Automotive Industry: The Heart of Germany Under Siege

No sector illustrates Germany’s economic chill more vividly than its automotive industry—the beating heart of the nation’s industrial might. Once a global symbol of precision engineering and innovation, the industry now faces a perfect storm of structural challenges, technological disruption, and geopolitical headwinds.

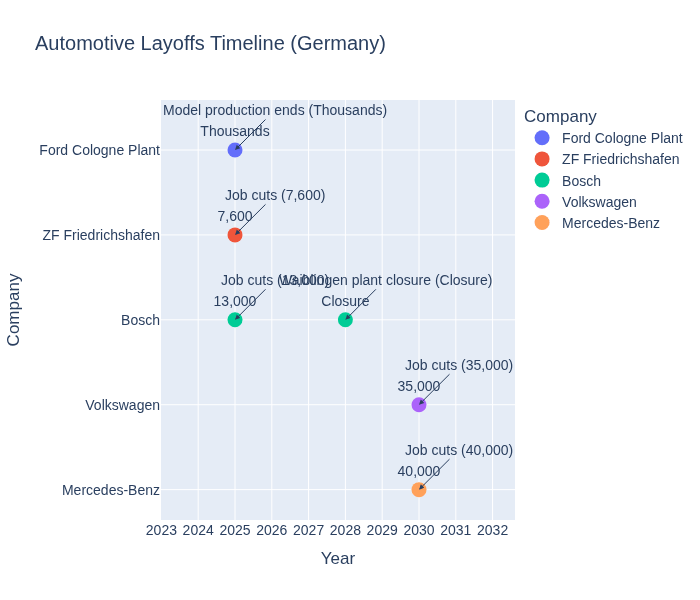

Massive Job Cuts and Plant Closures: The scale of restructuring is staggering. Volkswagen plans to eliminate 35,000 jobs in Germany by 2030, while Mercedes-Benz is preparing to shed 40,000 positions as it pivots toward electric mobility. Suppliers are equally hard-hit: Bosch is cutting 13,000 jobs and closing plants like Waiblingen by 2028, while ZF Friedrichshafen will slash 7,600 roles in its electrified drivetrain division. Ford’s Cologne plant is winding down production of key models, threatening thousands more jobs.

EV Transition: A Double-Edged Sword: The shift to electric vehicles (EVs) was meant to secure Germany’s future, but the transition has exposed deep vulnerabilities. Automakers are investing billions in EV platforms, yet sales remain sluggish due to policy uncertainty, high costs, and inadequate charging infrastructure. The abrupt end of EV subsidies in late 2023 compounded the crisis, while Chinese competitors flood global markets with affordable, tech-driven models.

Global Trade and Cost Pressures: Exports to the U.S. and China—Germany’s two largest automotive markets—have plunged, down 10% to the U.S. and 14% to China, amid tariff battles and slowing demand. At home, soaring energy prices and labor costs make German production increasingly uncompetitive compared to Eastern Europe and Asia.

Suppliers Under Siege: Suppliers like Bosch, Continental, and Schaeffler are grappling with collapsing orders and the heavy financial burden of EV investments. Many are scaling back combustion-engine components and accelerating plant closures to stay afloat. The Road Ahead: Industry analysts warn that without decisive policy action—clear EV incentives, robust charging infrastructure, and cost competitiveness—Germany risks losing its leadership in automotive innovation. If current trends persist, up to 186,000 jobs could vanish by 2035, turning the country’s proudest sector into its most fragile.

Mechanical Engineering

Germany’s machinery sector, once a global benchmark, now fears losing technological leadership. Over 50% of machine and plant manufacturers expect to fall behind international rivals. Investment freezes and layoffs are widespread as companies struggle with high energy prices and global protectionism.

Chemicals & Metals

Energy-intensive industries like chemicals and steel are shrinking under soaring electricity costs. ThyssenKrupp plans to shed 11,000 jobs by 2030, citing oversupply and rising imports.

Textiles & Packaging

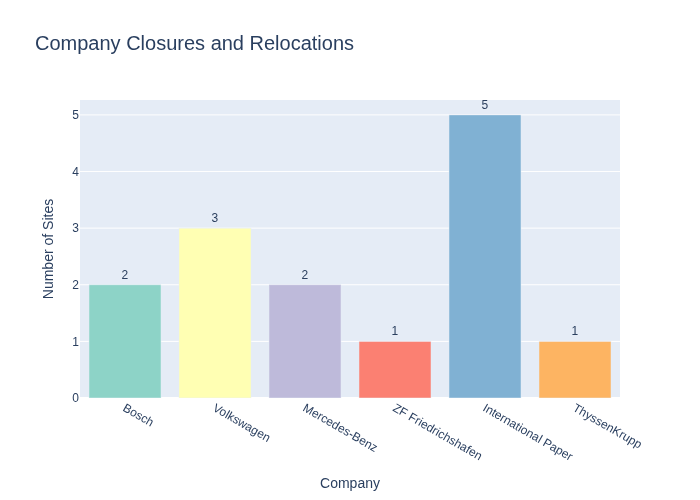

International Paper is closing five German sites, affecting 500 jobs, as part of a broader restructuring.

Factory Relocations and Business Closures

The exodus of companies from Germany is accelerating. Bosch will shut two factories by 2026, citing cost pressures and falling demand. Industry leaders warn of structural deindustrialization, with firms in chemicals, metals, and mechanical engineering moving production abroad. SMEs are also under strain: around 266,000 small and medium-sized businesses plan to close by the end of 2025, driven by succession failures and poor profitability.

The Human Cost

Behind these numbers are livelihoods. Surveys show four out of ten companies are preparing layoffs in 2025. Giants like Siemens, SAP, Ford, and Schaeffler have announced thousands of job cuts. The unemployment rate hovers around 6%, but the real picture is bleaker as temporary agencies and trade sectors slash positions.

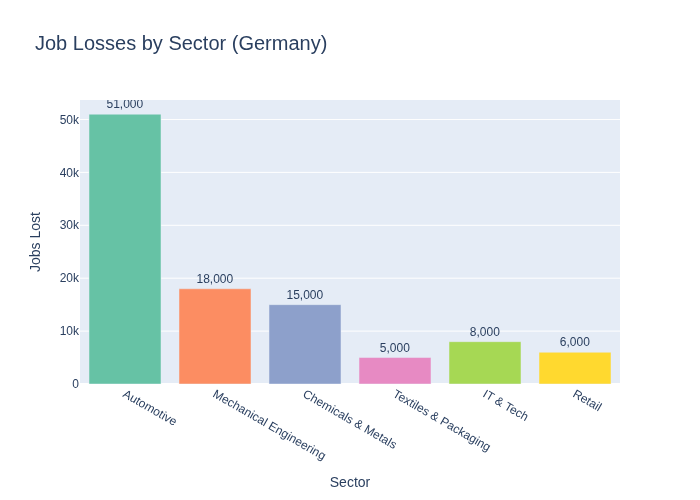

Visualizing the Impact

Here are two key charts illustrating the scale of the crisis:

Job Losses by Sector

Company Closures and Relocations

Is There a Silver Lining?

Despite the gloom, there are faint signs of resilience. Foreign investment is trickling in, and the construction sector shows modest growth thanks to government incentives. Yet these bright spots are overshadowed by the urgent need for structural reforms—digital transformation, green energy adoption, and streamlined regulations. Without decisive action, Germany risks a prolonged winter of economic stagnation.

Conclusion

This winter, Germany faces more than icy winds—it confronts a chilling economic reality. Factories relocating, businesses shuttering, and jobs disappearing paint a stark picture of an economy at a crossroads. Whether Germany can thaw this economic freeze depends on bold reforms and a renewed commitment to competitiveness.