Vignettes

Vignettes

-

U.S.-China Trade Talks – A Deal in Name, Not in Nature

After a grueling period of diplomatic stalemate and escalating tariffs, the United States and China have finally sketched the outlines of a new trade agreement. The announcement of a tentative framework, set to be finalized at an upcoming Trump-Xi summit in South Korea, has momentarily halted a dangerous slide toward a full-blown economic conflict. On the surface, this is a cause for relief. But beneath the veneer of progress, a deep and warranted skepticism persists. Given President Donald Trump’s established playbook, this “deal” is less a peace treaty and more a tactical pause—one that is likely to be shattered by the next round of threats. The Key Developments: A Closer…

-

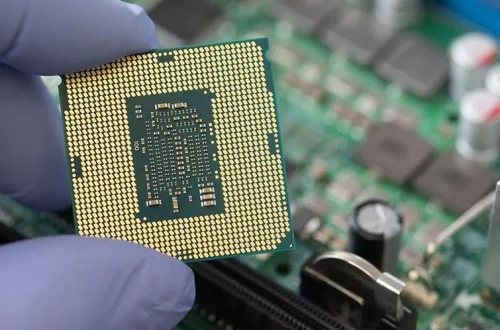

Global Responses to U.S. Government’s Stake in Intel

In a landmark move that reshapes the global semiconductor landscape, the United States government has acquired a 9.9% stake in Intel Corporation through an $8.9 billion investment. This decision, framed as a national security measure and a strategic effort to revitalize domestic chip manufacturing, has sparked a wave of reactions across the globe. While the deal is poised to strengthen Intel’s financial position and bolster U.S. technological sovereignty, it also raises concerns about market distortion, geopolitical tensions, and the future of international cooperation in the semiconductor industry. The Negative Impacts of the Deal 1. Geopolitical Tensions and Tech Decoupling The U.S. government’s direct control over Intel is widely interpreted as a…

-

China’s 1,000-Aircraft Megadeal: Duplication of Nvidia H20 Story?

In a stunning turn of events, China is reportedly, though no one can confirm as of yet, preparing to place two separate orders—each potentially involving up to 500 aircraft—with Boeing and Airbus. If confirmed, these deals would represent one of the largest aviation procurement moves in history, reshaping global aerospace dynamics and signaling a strategic shift in China’s diplomatic and economic posture. Boeing’s Bid for a Comeback After years of strained relations and halted deliveries, Boeing is reportedly in advanced talks to sell up to 500 aircraft to Chinese carriers. The deal is said to be part of a broader U.S.–China trade agreement, brokered under President Donald Trump’s renewed administration.…

-

Germany’s Auto Industry at a Crossroads in 2025

In yet chaotic 2025, Germany’s automotive industry— in long time a symbol of engineering excellence and economic might—is navigating one of the most transformative and turbulent chapters in its history. Once the undisputed leader in global car manufacturing, German automakers now find themselves grappling with a confluence of economic recession, technological disruption, and geopolitical headwinds. The question is no longer whether change is coming, but whether Germany can lead it. A Legacy Under Pressure For decades, brands like Volkswagen, BMW, and Mercedes-Benz have defined the global standard for quality, performance, and innovation. But the very foundations of this legacy are being shaken. Germany’s economy remains in recession, and the auto…

-

The EU–USA Tariff Deal: Sectoral Setback for Europe

Overview On July 27, 2025, the European Union and the United States finalized a landmark trade agreement that capped U.S. tariffs on most EU goods at 15%, averting a previously threatened 30% escalation. In return, the EU committed to significant energy purchases and investment flows into the U.S., while removing tariffs on select American exports. While the deal stabilizes transatlantic relations and offers strategic benefits, it also introduces sector-specific challenges for the EU economy. 1. Automotive Industry: A Competitive Blow Tariff Impact: U.S. tariffs on EU automobiles remain at 15%, down from the threatened 30% but still above the pre-deal 10% Negative Effects: 2. Steel and Aluminum: A Sector Under…